What Is Deferred Income And Why Is It A Liability? Bench Accounting

For instance, your personal household expense of $1,000 to purchase the latest smartphone is $1,000 revenue for the phone firm. The major component of income is the amount sold multiplied by the worth. For a retailer, that is the number of items bought multiplied by the sales worth. A company’s revenue may be subdivided according to the divisions that generate it. For instance, Toyota Motor Corporation might classify income throughout every sort of auto.

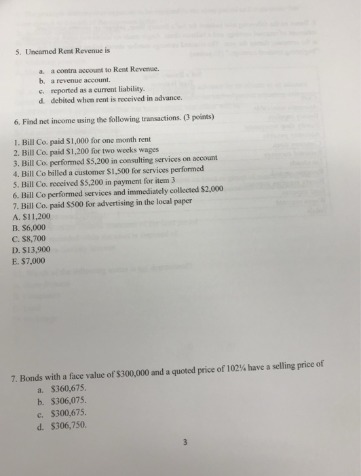

On your steadiness sheet, unearned revenue must be listed beneath present liabilities and added to your whole liability amount. Accounting for unearned income on your monetary statements is crucial, both as an accurate record of your financial position and to make sure you retain the best information for the ATO. Landlords, companies that provide a subscription service, or these in the travel or hospitality industry might receive nearly all of their payments for unearned revenue.

- In conclusion, the proper accounting therapy of unearned income is necessary for accurate illustration of a company’s financial well being.

- Unearned revenue is useful to cash circulate, based on Accounting Coach.

- Nevertheless, over time, it converts to an asset as you deliver the services or products.

- Income is the whole cash a company earns and is recorded as sales on a company’s earnings statement.

Despite the name, unearned income isn’t a sort of revenue that shows up in your income statement. As An Alternative, it goes on the stability sheet as a legal responsibility (something you owe) to offset the money acquired when a enterprise is paid prematurely. The income recognition idea states that the revenue ought to be recognized when the goods are delivered or companies are rendered, and there’s a certainty of cost realization.

How Does Unearned Income Affect Financial Statements?

As the business delivers its product or service, it transfers a portion of the unearned income into earned revenue. This process ensures that income is recorded within the appropriate bookkeeping interval. Unearned revenue, typically referred to as deferred income, is if you obtain cost now for companies that you will present sooner or later in the future. Unearned income affects a business’s steadiness sheet, earnings assertion, cash circulate assertion, and monetary analysis. Below, we’ll walk through how to document unearned income, how unearned income impacts monetary statements and stability sheets, and examples of unearned income.

Publishing And Prepaid Providers

At the end of month 12, the $60 in income shall be totally acknowledged unearned revenue and unearned income might be $0. The goods or companies are supplied upfront, and the shopper pays for them later. The accounting precept of income recognition states that income needs to be acknowledged when it’s earned, not necessarily when payment is collected.

Unearned Income: What It Is, How It Is Recorded And Reported

The customer chooses to pay the full amount earlier than the work begins, so the revenue is recorded as a $500 debit within the cash account and a $500 credit score in the ‘unearned revenue’ account. Two weeks later, when the project is finished, the business makes an adjusting entry, which debits $500 from the unearned income account and credit the revenue account $500. Beneath the rules of accrual accounting, income is recognised as revenue when it’s earned, not when cash enters your account (cash accounting).

In terms of actual estate investments, revenue refers to the earnings generated by a property, such as rent or parking charges. When the working bills incurred in operating the property are subtracted from property income, the ensuing worth is internet operating earnings (NOI). Governments collect income from citizens inside its district and collections from other authorities entities. Income may additionally be divided into operating revenue—sales from an organization’s core business—and non-operating income, which is derived from secondary sources.

Understanding the distinction between unearned and earned income is crucial for correct financial reporting. For most businesses where prepayment phrases are 12 months or much less, unearned revenue is treated as a present liability on the stability sheet. Creating and adjusting journal entries for unearned revenue shall be easier if your corporation makes use of the accrual accounting methodology, of which the income recognition precept is a cornerstone.

After James pays the store this quantity, he has not yet received his month-to-month packing containers. Subsequently, Beeker’s Mystery Boxes would document $240 as unearned revenue of their data. James enjoys surprises, so he decides to order a six-month subscription service to a well-liked mystery box firm the place he’ll obtain a themed field https://www.quickbooks-payroll.org/ every month stuffed with shock gadgets.

This means unearned revenue is listed as a legal responsibility in your balance sheet till your small business delivers the promised providers or items. When a business receives an advance payment, it should classify the amount as unearned income under liabilities, not revenue or asset. The fee represents a company’s obligation to deliver a product or service in the future. Subscription-based firms rely on unearned income to take care of regular cash flow and put cash into product enhancements. Since over 83% of adults in the united states use at least one subscription service, businesses in this house must fastidiously monitor and handle deferred income to make sure correct financial reporting.

| No. | Currency | BUYING RATE | SELLING RATE |

|---|---|---|---|

| 1 | USD | ||

| 2 | GBP | ||

| 3 | EUR | ||

| 4 | AED | ||

| 5 | AUD | ||

| 6 | CAD | ||

| 7 | JPY | ||

| 8 | SAR |